jersey city property tax rate 2020

To view Jersey City Tax Rates and Ratios read more here. Jersey city property tax rate 2020 Read More.

How Do State And Local Sales Taxes Work Tax Policy Center

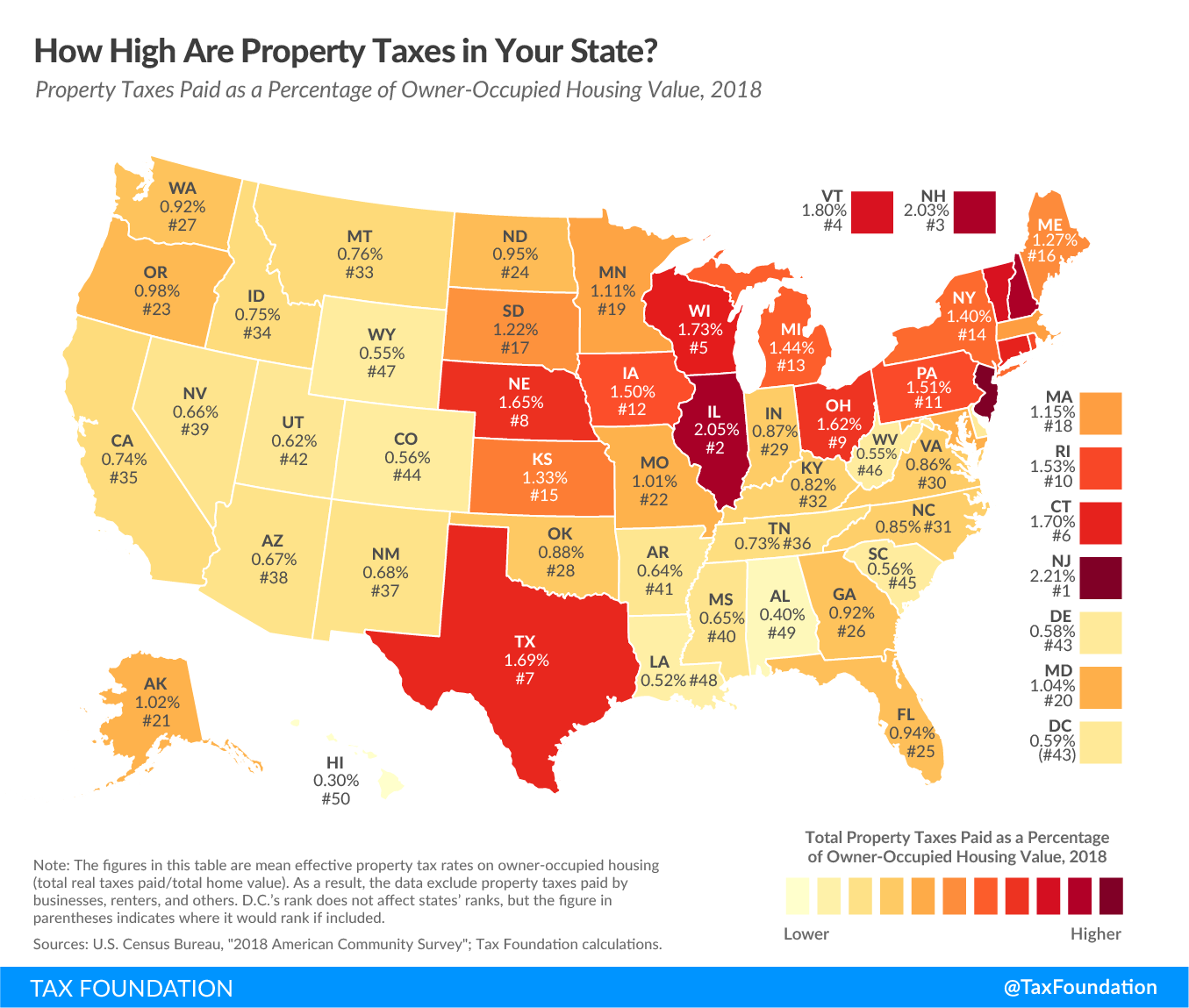

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119.

. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. In 2020 and 2021 driven by the leadership of Superintendent Franklin Walker and under intense pressure from advocates with. 189 of home value.

All 21 counties in. Description The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation. Ad Looking for Jersey City Tax Records.

GMAT coaching in ChandigarhPunjab Read More. HOW TO PAY PROPERTY TAXES. Ad Be Your Own Property Detective.

Search For Title Tax Pre-Foreclosure Info Today. The City of Jersey City Powered by Civiclive. Visit Our Website Today.

Search Any Address 2. The minimum combined 2022 sales tax rate for Jersey City New Jersey is. The city of Jersey Village is looking to adopt a lower property tax rate for the 2020-21 fiscal year but one that will.

By Mail - Check or money order payable to. Of this 325 million or about 47 will be funded by city property tax. While Jersey City has the lowest property tax rate in Hudson County with a General Tax Rate of 161.

Property Tax Rate per 100 2019-2020 2020-2021 Difference Debt Service 0136379 0132072 -004307 Operations. 2020-2022 Agendas Minutes and Ordinances. 2020-2022 Agendas Minutes and Ordinances.

City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel. Jersey city property tax rate 2020 Monday February 28 2022 Edit. Dog License Film Permit Food Truck Parking Space Job with Jersey City Parking Permit Recreation Field Permit Small Business Permit.

City of Jersey City Tax Collector. Average Effective Property Tax Rate 2020 Atlantic County. Overview of New Jersey Taxes.

Homeowners in New Jersey pay the highest property taxes of any state in the country. 2019 Agendas Minutes. Jersey City establishes tax levies all within the states statutory rules.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Reduce property taxes 4 residential retail businesses - profitable side business hustle. Ad Reduce property taxes for yourself or residential commercial businesses for commissions.

2020-2022 Agendas Minutes and Ordinances. Real estate evaluations are undertaken by the county. Find New Jersey Tax Records Fast.

City of Jersey Village Property Tax Rate Fiscal Year 2020-2021. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel.

252 551721 252 05 252 51 252. Implementing legislation is found in New Jersey Statutes Annotated Title NJSA. Studying in Australia immigration consultants in Chandigarh Read More.

Revenues in 2022 total 695 million. See Property Records Tax Titles Owner Info More. City Hall 280 Grove Street.

Real property is required to be assessed at some percentage of true value established by the county board of taxation in each county. 280 Grove St Rm 101. Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future.

Jersey city property tax rate 2020 Read More. Tax amount varies by county. In Person - The Tax Collectors office is open 830 am.

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy. The average effective property tax rate in New Jersey is 242 compared with a national average of 107. POSSIBLE REASONS BEHIND STUDENT VISA REJECTION Read More.

Employer Payroll Tax LandlordTenant Relation Fees Municipal ComplaintTraffic Ticket PermitsLicensesOther Fees Property Taxes Suez Water Bill AlertJC Recreation. TOWN GENERAL TAX RATE 2020 EFFECTIVE TAX. 2019 Agendas Minutes.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Eduardo CToloza CTA City Assessor.

City of Jersey City. The average effective property tax rate in New Jersey is 242 compared to. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. In fact rates in some areas are more than double the national average. Online Inquiry Payment.

The balance of the city budget 370 million would be funded by other sources including abatement PILOT fees 101 million COVID19 federal aid 70 million state aid 64 million local revenues 41 million and more. Jersey city property tax rate 2020. Things You Need to Know About Canadian Education System.

Property Values 800000000 850000000 900000000.

Property Taxes By State County Lowest Property Taxes In The Us Mapped

State Corporate Income Tax Rates And Brackets Tax Foundation

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Iowa S High Property Taxes Iowans For Tax Relief

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

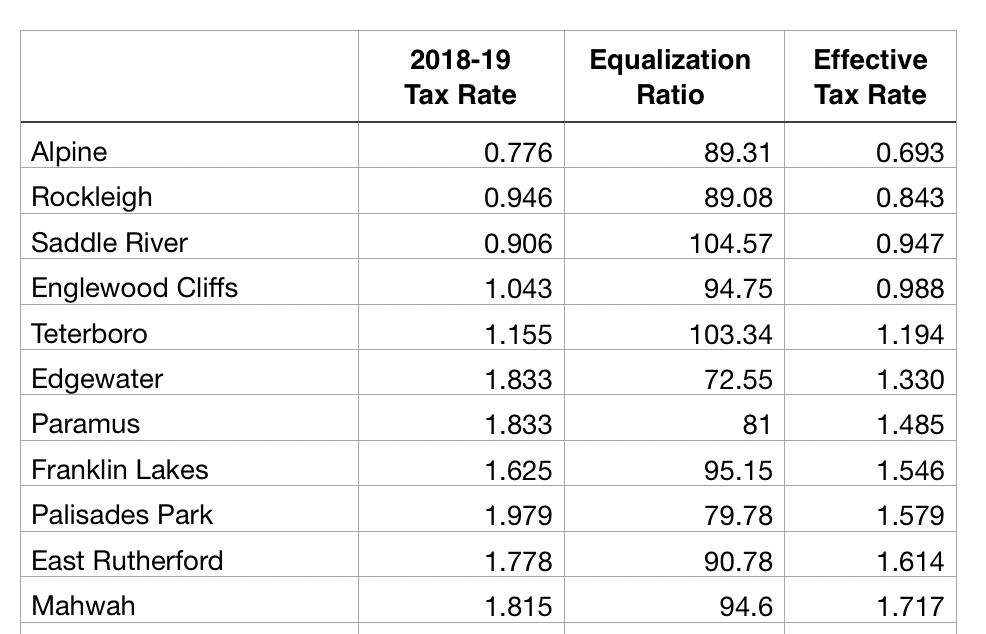

Bergen County Tax Rates For 2018 2019 Michael Shetler

2022 Property Taxes By State Report Propertyshark

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

New York Property Tax Calculator 2020 Empire Center For Public Policy

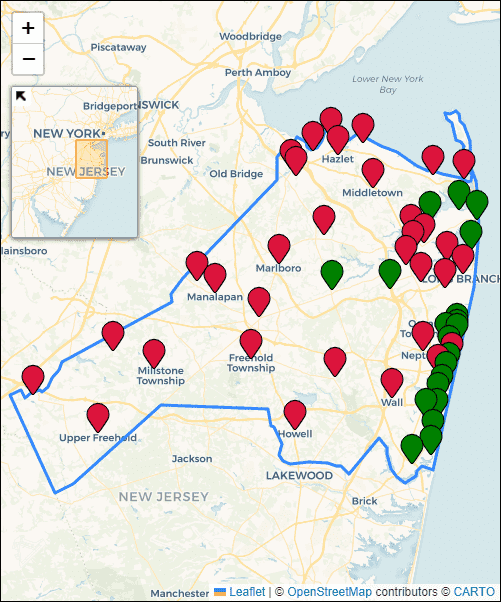

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Utah Sales Tax Small Business Guide Truic

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

State Income Tax Rates Highest Lowest 2021 Changes

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future